It is not in the interests of any investors or entrepreneurs to talk about bubbles. They are too profitable for some. Besides, ‘this time it’s different‘, is the stock response to anyone who question the increasingly high valuations of some companies.

It is in everyone’s interests to understand the implications and what this means for other companies.

Unicorns are Good M’kay

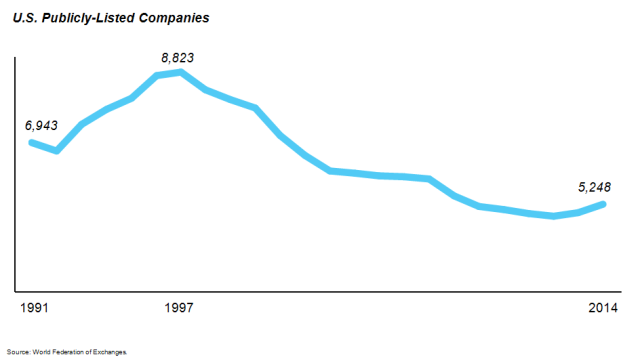

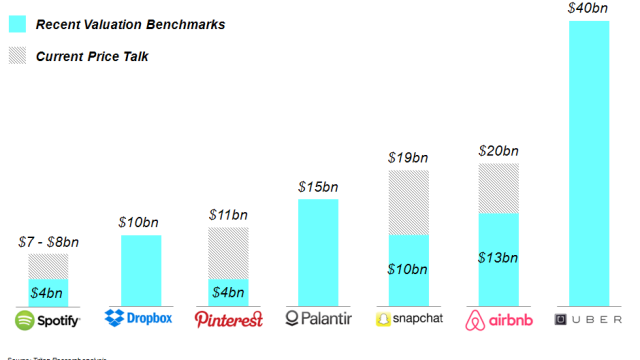

All investors want to be invested in ‘unicorns’ private companies with a putative $1 billion valuation. It makes them look good and helps them raise further funds where they can earn a management fee. At the same time, the amount of money invested into technology companies on the public markets is down and the bar for an IPO has risen to $100 million annual revenue and even more. This is part of a general trend towards fewer publicly listed companies:

While the number of public companies has fallen, the Unicorn has replaced the IPO in some people’s minds as a bellweather for the health of the technology ecosystem and point to the increasing number of ‘Unicorns’ and ‘Decacorns’ as evidence of the health and vigor of the new order.

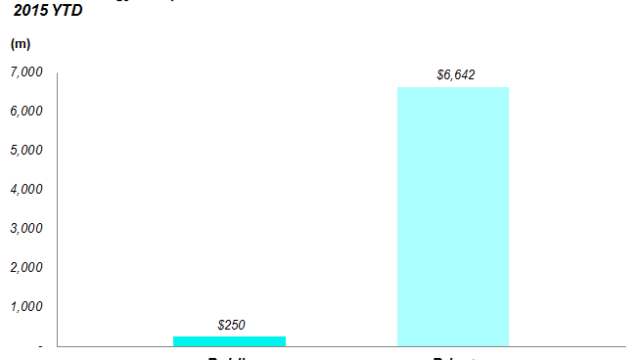

Why go public and face all the inconvenience of transparency, expense and reporting on the public markets when you can stay private and still raise capital? Particularly when there is a huge amount of money looking to invest in later stage private companies:

Primary Equity Issuance US Technology Companies: Triton Equity Research

So companies can become very valuable and still be private, where is the problem?

The Unicorn Problem

Simply, private company valuations are theoretical – there is usually very little liquidity in the stock and so while investors, entrepreneurs, employees can all sit on huge amount of wealth, on paper, the valuations are paper valuations. Many of these companies are very early stage and simply not ready to live life on the public markets. In many case, the valuations are inflated simply to achieve ‘Unicorn’ status.

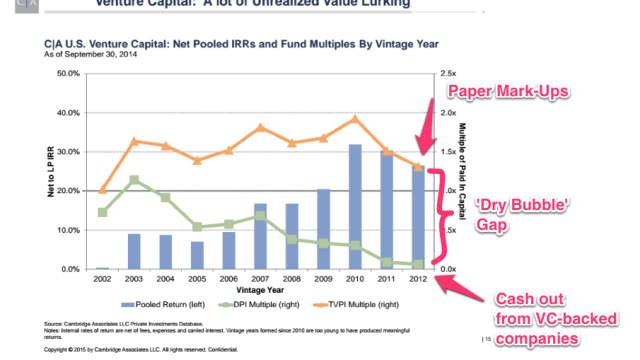

Bill Gurley, legendary Silicon Valley VC noted earlier this year that it is a lot more fun operating in a ‘wet bubble’ than a ‘dry bubble’. What he meant was simple. In the last ‘bubble’ and crash, investors were making real money (not that it was always sustainable in the longer term) by selling their stakes at IPO. If they kept stock, the valuations of the companies continued to grow and so it was a simple matter to realize the value of the stock – if a company is publicly traded, you can sell the stock at any time.

Today, there has never been such a high valuation to cash ratio in the world of venture capital (investors value their funds on the basis of the cash they hold and the value of the investments they have in private companies. The amount of ‘value’ investors currently report to their limited partners has never had a higher illiquid component.

This chart, from Saastr, shows how the significant proportion of value of VC portfolios is in paper money. Not the green kind you can spend, but the virtual kind that you cannot.

What can you do if you are not a unicorn?

Relax. Don’t worry about it. Keep making great software.

If you are worried that your business isn’t a unicorn, don’t panic, most of the 200 or so private company unicorns identified across the globe will die. For every Facebook, there will be multiple Fab.coms (Once a unicorn, sold for $15 million last year). Unicorns are outliers, often artificially created entities, that create easy headlines for journalists and perpetuate the notion that scale equates to value. They’re also likely to contribute to long term issues for employees and founders who will discover one day that their stock is not worth anything like what they thought it was.

The BLN is now Business of Software

Business of Software runs conferences for people that build great software businesses and products. To access talks online, hear about new events, contact speakers and stay in touch with great ideas, share your email address with us.